Walmart Adopts Controversial New Self-Checkout Measures Amidst Shoplifting Concerns

Walmart’s recent venture into the world of “buy now, pay later” (BNPL) services at its self-checkout kiosks has triggered a heated discussion about the consequences for consumers and the retail landscape as a whole.

Being the pioneer among major retailers embracing this controversial payment method, Walmart finds itself on a journey fraught with convenience and concerns regarding financial responsibility.

Self-Checkout Revolution

The self-checkout revolution, while convenient for some, has brought forth a cascade of challenges.

Source: LAUISAOM vusk OWMD 200/Wikimedia Commons

From customers feeling burdened by the responsibility of scanning items to the unintended consequences of increased shoplifting, the shift from cashier-assisted transactions to self-service has stirred a notable upheaval. Honest patrons are disgruntled not only by the additional workload but also by the implicit lack of trust conveyed by the store.

Makeshift Security Personnel

Walmart’s heavy reliance on self-checkout has necessitated the deployment of workers as makeshift security personnel, actively monitoring customers for potential theft.

Source: Walmart/Wikimedia Commons

On-the-spot decision-making, such as the impromptu shutdown of self-checkout lanes to investigate suspicious activity, thrusts front line staff into a security role for which they may not have been adequately prepared.

Walmart's Theft Issues and Policy Adjustments

Walmart CEO Doug McMillon acknowledged the company’s struggle with theft, stating to CNBC, “Theft is an issue. It’s higher than what it has historically been.”

Source: Karsten Winegeart/Unsplash

This situation has led Walmart to implement adjustments in its policy, including receipt checks, to curb losses due to theft.

The Receipt Check Controversy at Retail Giants

The U.S. Sun reports that at Walmart and Costco, receipt checks at the exit have become a common practice, sparking debates among shoppers.

Source: Karolina Grabowska/Pexels

Legally, shoppers aren’t obliged to show their receipts, but refusal can lead to complications. Business Insider reports that refusing to show your receipt could give a store probable cause to detain you. This policy has even led to legal actions, as seen in a case where a customer sued Walmart after being detained for not showing receipts, although Walmart was not found liable for false imprisonment.

Why Receipt Checks Matter to Retailers

Receipt checks, despite causing customer tension, serve a crucial purpose for retailers like Walmart and Costco. The primary reason is theft prevention. Retail theft rates are climbing, significantly impacting stores, as per information from Business Insider.

Source: Sean Lee/Unsplash

For instance, Dollar Tree is considering securing more products due to theft. Walmart’s CEO has stated to CNBC that stores might close if theft rates don’t decrease. These measures, while potentially inconvenient for customers, are a response to the growing challenge of retail theft.

Uncomfortable Encounters at Walmart Self-Checkout

Charles Bisbee, a former U.S. Marine, experienced an awkward situation at a Walmart self-checkout in Alamogordo, New Mexico. He told Business Insider how an employee, suspecting theft, confronted him about an energy drink mix in a tone Bisbee found confrontational. Despite showing the item was scanned, Bisbee felt embarrassed, especially in a small community where reputation matters.

Source: Getty Images

Employees are instructed not to accuse customers of theft, but the technology often puts them in challenging positions, leading to uncomfortable interactions.

Legal Concerns Over Self-Checkout Usage

Legal experts have raised concerns over the use of self-checkouts. Criminal defense attorney Lindsey Granados, in a TikTok video, warned against self-checkouts, noting the risk of criminal charges due to machine errors.

Source: ldbglawyer/TikTok

Granados said, “If you somehow didn’t scan something appropriately or the machine didn’t pick it up accidentally when you scanned it, you could potentially be charged with misdemeanor larceny or felony larceny, depending on how big the item was.”

Self-Checkout Technology: Convenience or Complication?

Self-checkout technology, while designed for convenience, has led to various complications. The Associated Press reveals that customers have reported issues with clunky technology and error codes, causing frustration.

Source: Brittani Burns/Unsplash

Workers find themselves overseeing both humans and machines, leading to increased demands on their time. Retailers, while aiming to save on labor costs, are also facing challenges in managing theft and customer satisfaction.

Tensions Rise Over Walmart’s Anti-Theft Self-Checkout Tech

Walmart employees are reporting increasing hostility from customers at self-checkout kiosks due to new anti-theft measures. These technologies, which pause transactions and alert staff over unscanned items, are leading to confrontations.

Source: Getty Images

Business Insider highlights incidents where customers, feeling accused, react defensively, sometimes aggressively. Mendy, a Walmart employee, shared experiences of customers throwing items in frustration.

Retailers Reconsidering Self-Checkout Strategies

In response to customer feedback and operational challenges, some retailers are reevaluating their self-checkout strategies. The Associated Press reports that Walmart removed self-checkout kiosks in three Albuquerque stores but continues to add more overall.

Source: Wikimedia Commons

Target limits the number of items in some stores, and British supermarket chain Booths has been removing self-checkouts due to customer backlash.

Advances in Self-Checkout Technology

Retailers like Kroger are implementing advanced technologies in self-checkout systems. Kroger employs artificial intelligence to trigger alerts when a scanning error occurs, as reported by The Associated Press.

Source: Wikimedia Commons

This technology aims to minimize errors and enhance the customer experience. However, the integration of such technologies also raises concerns about customer privacy and the reliability of the systems.

The Future of Self-Checkout in Retail

The future of self-checkout in retail remains a topic of debate. Despite challenges, the technology is not likely to disappear, as it addresses labor shortages and offers convenience for many customers, as noted by The Associated Press.

Source: Jack Sparrow/Pexels

However, the implementation of self-checkout systems must balance efficiency, customer experience, and loss prevention to be sustainable in the long term.

Walmart Embraces 'Buy Now, Pay Later'

Target and Kroger have responded to the challenges they have faced with varying strategies.

Source: Baron Maddock/Wikimedia Commons

Walmart has not only boldly embraced self-checkout, taking it a step further by incorporating BNPL services.

Walmart’s BNPL Services

In collaboration with Affirm, Walmart now allows eligible shoppers to make purchases over time for a range of products, spanning electronics to apparel and toys.

Source: Affirm, Inc./Wikimedia Commons

This groundbreaking approach recognizes the fact that over half of Americans actively seek BNPL options at checkout, according to Affirm Senior Vice President Pat Suh.

The Rise of 'Buy Now, Pay Later' in Grocery Shopping

A recent study, “Tracking the Digital Payments Takeover: What BNPL Needs to Win Wider Adoption,” by PYMNTS in collaboration with Amazon Web Services, surveyed over 3,100 consumers.

Source: Towfiqu barbhuiya

It revealed that 20% of the participants used “Buy Now, Pay Later” (BNPL) services, with 56% of them employing this method to purchase groceries.

A Problematic Partnership with Affirm?

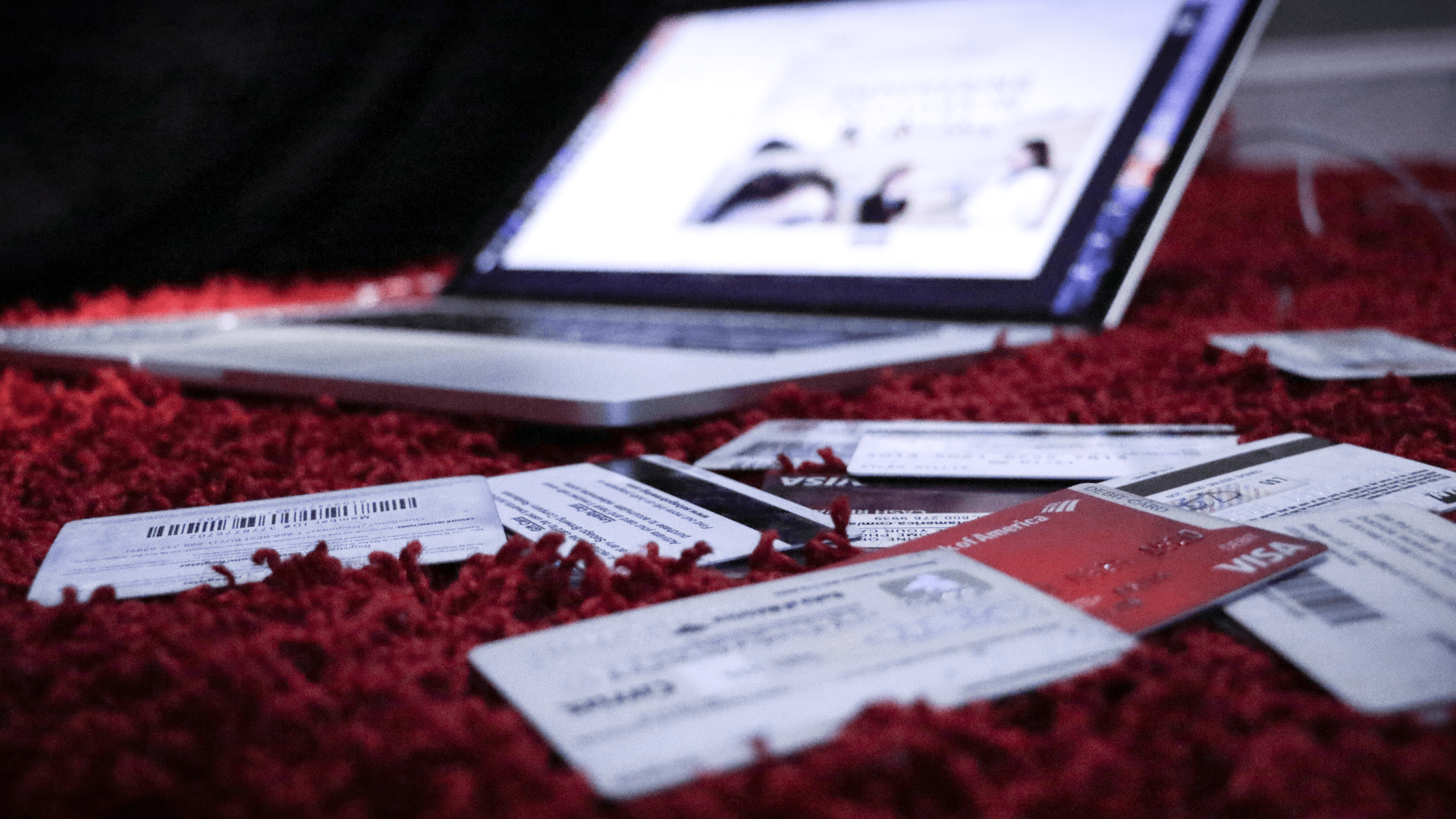

However, this partnership with Affirm introduces a set of unique challenges. Unlike traditional credit card companies, BNPL services such as Affirm do not report to major credit bureaus.

Source: Library of Congress/Wikimedia Commons

Consequently, Walmart customers utilizing BNPL may be accumulating debt that remains invisible in their credit histories. While this flexibility may be liberating for those with the financial means to repay the loans, it poses a precarious proposition for individuals already grappling with financial constraints.

Affirm Doubles Down

Affirm defends its services by emphasizing research that suggests a substantial portion of consumers would defer or bypass purchases without BNPL options.

Source: Boxed Water Is Better/Wikimedia Commons

This places Walmart in a delicate position, caught between catering to consumer demands for flexibility and the potential exposure of some customers to unforeseen financial strains.

Economic Challenges Influencing Grocery Shopping Trends

According to intelligence from PYMNTS’ “New Reality Check: The Paycheck-to-Paycheck Report,” created with LendingClub, 21% of consumers were living paycheck-to-paycheck with bill-paying difficulties in July, an increase from 19% a year earlier.

Source: Mick Haupt/Unsplash

Rodney McMullen, CEO of supermarket chain Kroger, noted, “Our budget-conscious households are buying fewer items, particularly as [Supplemental Nutrition Assistance Program (SNAP)] benefits declined during the quarter.”

U.S. Government Concerns

The U.S. government’s Office of the Comptroller of the Currency has voiced concerns about the incomplete reporting of BNPL loans.

Source: Dylan Gillis/Unsplash

The agency warns that existing credit scoring systems are ill-equipped to capture the short-term nature and structure of these loans, potentially complicating lenders’ assessments of applicants’ total debt obligations.

How Does a BNPL Loan Work?

A BNPL loan is a type of installment loan, meaning that it divides your payment for services or products into a number of equal payments over time. The first payment is due upon checkout.

Source: Nathana Rebouças/Unsplash

The remainder of the equal payments are billed to your debit card, credit card, or bank account on a consistent schedule until you finally pay off the entire cost of the purchase.

Thorough Examination of Walmart’s BNPL Services

This intricate landscape calls for a thorough examination of Walmart’s strategic decision to integrate BNPL at self-checkout.

Source: Agence Olloweb/Unsplash

While aligning with consumer preferences for flexible payment options, it raises ethical questions about the potential for customers to undertake debt beyond their means.

Ethics of BNPL Loans

One of the major issues with BNPL loans is that, as of now, they are pretty much unregulated by larger bodies. This lack of oversight leaves much of the ethical dealings of the loans up to the provider of the BNPL.

Source: José Martín Ramírez Carrasco/Unsplash

This could potentially lead to predatory practices, as buyers can rack up large sums of debt quickly. It’s somewhat similar to the heavily criticized check-cashing loan industry. Consumers can be left with large interest rates that force them to pay more on interest than the amount of the original purchase.

Is Walmart Setting a Trend?

As BNPL services gain traction, Walmart’s move may signify a turning point in how retailers navigate the delicate balance between convenience and financial responsibility at the checkout counter.

Source: Stephen Phillips/Unsplash

Only time will unveil the true impact of this controversial decision on Walmart and the broader retail industry.